This is the third article in a series on money I’m writing. If you haven’t read the previous articles, start here. The purpose of this series is to maximise your enjoyment of your life’s journey.

In the previous two articles we set ourselves up for success by doing a lot of introspection and strategising. Now, to achieve our ideal vision for our life, we need to take action. Here is where the rubber meets the road.

You can be someone who executes.

This article could have been called just that: How To Execute. Great execution is one part courage, one part discipline, and one part patience. The courage to act on your vision, the discipline to keep going, and the patience to see things through to completion.

Money is an excellent area of your life to start proving to yourself that you are someone who executes. When you prove something to yourself over and over, it becomes a part of your identity. For example, if you identify as someone who cares a lot about health and fitness, then even on days where you don’t want to go to the gym, you’ll still go because that’s your identity and it reflects what’s important to you.

The reason that personal finance is such a great area of your life to start executing well is because it positively affects all areas of your life. It also happens to be relatively simple. The easiest way to execute well with money is to automate. ⚙️ Let’s go!

Why should I automate?

There is only one reason to automate as much of your financial life as possible: it will help you achieve your ideal vision for your life with less effort.

Automation makes you wealthy in two ways. Firstly, it gives you back your time. By not having to manually transfer money every time you pay a bill or make an investment, it frees up time and mental space you can now use more meaningfully. Secondly, it makes you wealthy financially. Setting up an automation to invest or save up for something is the one decision that eliminates a thousand decisions. When you automate the way you invest, you don’t have to decide each week whether to invest or not. It happens automatically.

The time it takes to set up an automation will give you some of the highest returns on your time you will ever experience. It’s never been easier to win back time and grow your wealth, provided you take the time to execute.

What should I automate?

The best things to automate are regular payments like bills. Once your bills are automated, the next best thing to automate is your investing.

Lastly, if you’re self employed, automation is key to building the system that runs your business. We’ll cover how to get started with all of these.

How to automate your recurring bills

The first automation most people set up is for paying rent. Ever wondered why you’re so good at paying your rent on time, but not so good at managing money in other areas of your life? This is the power of automation. Your landlord isn’t the only person who deserves to experience the benefits. It’s time to love yourself as much as you love paying your landlord. Okay, that analogy doesn’t quite work, but you get the idea.

Everyone pays bills, so let’s get our first win by fully automating how we pay a bill.

- Choose a recurring bill (e.g. Internet, which you might pay monthly)

- Google search ‘How to automate [type of bill] [company]’ (e.g. ‘How to automate internet bill Spark’.) Most companies have an article on their website encouraging you to set up an automation to pay them, because they know you’re more likely to pay on time if you do.

- Follow the instructions to set up an automatic payment.

- If your bank charges a small fee for automatic payments, ignore it. It is insignificant in the long term. Now that you’re doing a good job managing your money, banks know they’re going to have a hard time making any money off you any other time, hence the fee.

- Set a calendar reminder on the first day the automation happens so you can check that it works.

Sometimes there are no online instructions or you might decide you don’t want to fully automate a bill. In this situation, you can still partially automate. This means automating part of the process, with the rest still done manually.

I have partially automated how I pay my internet bill, because sometimes the internet company makes mistakes, which I want to manually correct before paying them. The way I did this was to log into my internet account and in Settings, I ticked a box to have them email the bill to me. When the bill gets emailed, I manually check it for mistakes before I pay. The automated part is them emailing the bill. The manual part is where I check the bill for mistakes and then pay it.

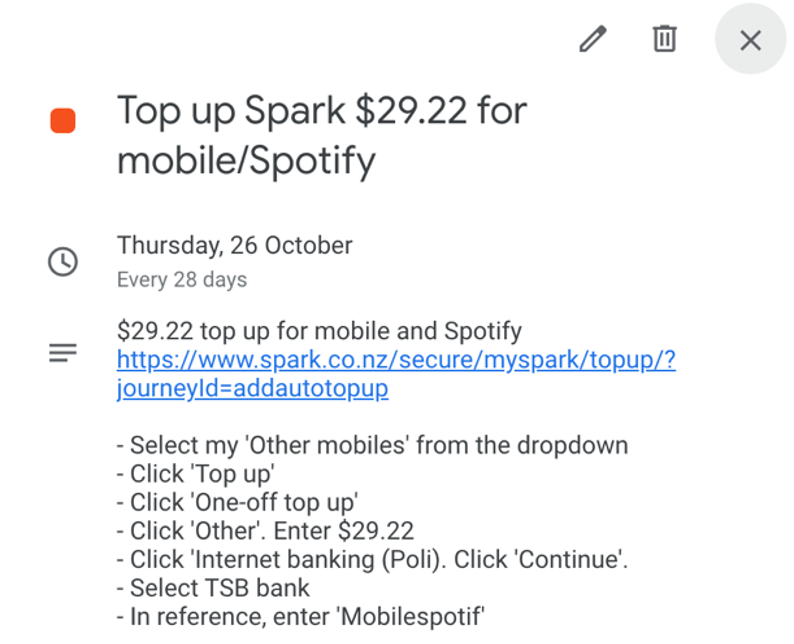

If the company won’t email when a bill is due, you can partially automate with calendar reminders. I’m on a pre-paid mobile plan, so I don’t get email notifications when I need to top up. I’ve created a monthly recurring event in my calendar that reminds me to top up a couple of days before the monthly auto payment pays the bill.

This is a screenshot of the actual reminder task in my calendar:

All I need to do is click on the link, follow my instructions and the auto payment takes care of the rest!

Automating how you pay your bills—fully or partially—builds your confidence with automating. Now here’s where things really start to get fun.

How to automate your investments

With all of your bills fully or partially automated, you’re going to be wondering what to do with all the extra time. Naturally, the answer is to automate your investments!

The first time you pay a bill, you’re probably not going to set up an automation. You’re still getting a feel for how the bill works, where the money needs to go and checking the bill is accurate. The second time you pay the bill, you should probably set up an automation.

It makes sense to approach investing the same way.

There are 5 steps to automating how you invest, which I will show you how to apply to different types of investments.

1. 🧪 Manual confidence booster

The purpose of this step is to build your confidence. Slowing things down and doing them manually allows you to understand the process, correct any mistakes you make and learn about the investment platform you’re using.

2. 🧠 Learn and reflect

Watch what happens to your money as you manually move it from one location to another and reflect on how it makes you feel. Did your money end up where you thought it would? Is everything making sense? Were there any surprises? Get curious and ask questions when something doesn’t make sense.

3. ⚙️ Automate your investment

Remove yourself from the process by setting up automations. The investment platform you use will have instructions on how to do this, which you can find on Google.

4. 🕵️ Monitor first time

The first time your automation triggers, keep a close eye on things. Set calendar reminders on the days your money is due to arrive in a new location. Check that it arrives. If things don’t go to plan, it’s okay. Simply edit the automations.

5. 📈 Measure your progress

Once a month, write the amount your investment is worth into a spreadsheet. This helps with staying the course. Over time, it’s incredibly motivating and fun to see your progress captured in a colourful graph.

Now let’s apply these steps to three different types of investments: real estate, index funds and a business (for those of you that are self employed). Setting these up requires concentration, so remember to be patient with yourself and give yourself permission to make mistakes.

Automation for saving up for a house deposit

GOAL: make it easy to save up a deposit for a house – either to live in or to invest in.

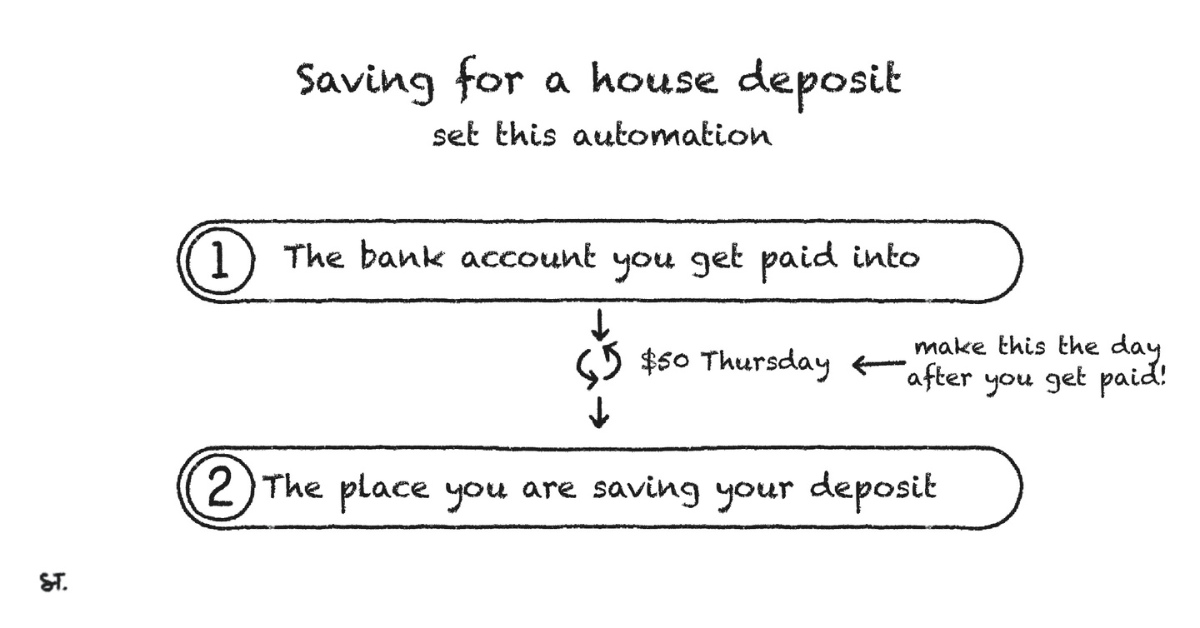

The diagram below captures what you need to know. Keep reading for a more detailed walkthrough.

Apply these steps to automate how to save up for a house deposit.

- 🧪 Do a Manual Confidence Booster. (e.g. Manually invest $50 into the account you’ve decided to save for a house deposit. If you plan on buying in the next 5 years, a high interest savings account on your internet banking or with another bank is an excellent place.)

- 🧠 Learn and reflect. Did your money end up where you thought it would? How do you feel seeing your money set aside for the future house deposit? Are you tempted to withdraw the money and use it for something else? It’s okay to linger on this step for a while.

- ⚙️ Automate your saving.

- Google search how to set up an automatic payment using the bank you are using. (e.g. “ANZ automatic payment”. Most banks have easy to follow articles about how to do this.)

- Automate your saving. Let’s say you decide to save $50 every week. To do this, you will need to set 1 automation. (See diagram above.) This automation sends money from your bank account to the account where you are saving your deposit. A good time to set the automation to occur is the day after you get paid.

- 🕵️ Monitor the progress of your money the first time. Monitoring the movement of your investment manually gives you a greater understanding of the timing and therefore, on what days to set up your automation to happen.

- 📈 Measure your progress. Open a spreadsheet (I use Google Sheets) and in the first column write ‘Month’. In the second column write ‘Amount’. Set a calendar reminder on the 1st day of each month to log into your savings account, note the Amount your savings are worth and record this in your spreadsheet. For bonus points, use the data to create a graph – it’s incredibly motivating and fun to see your progress over time.

Automation for investing in index funds

GOAL: make it easy to invest in index funds each week/fortnight/month.

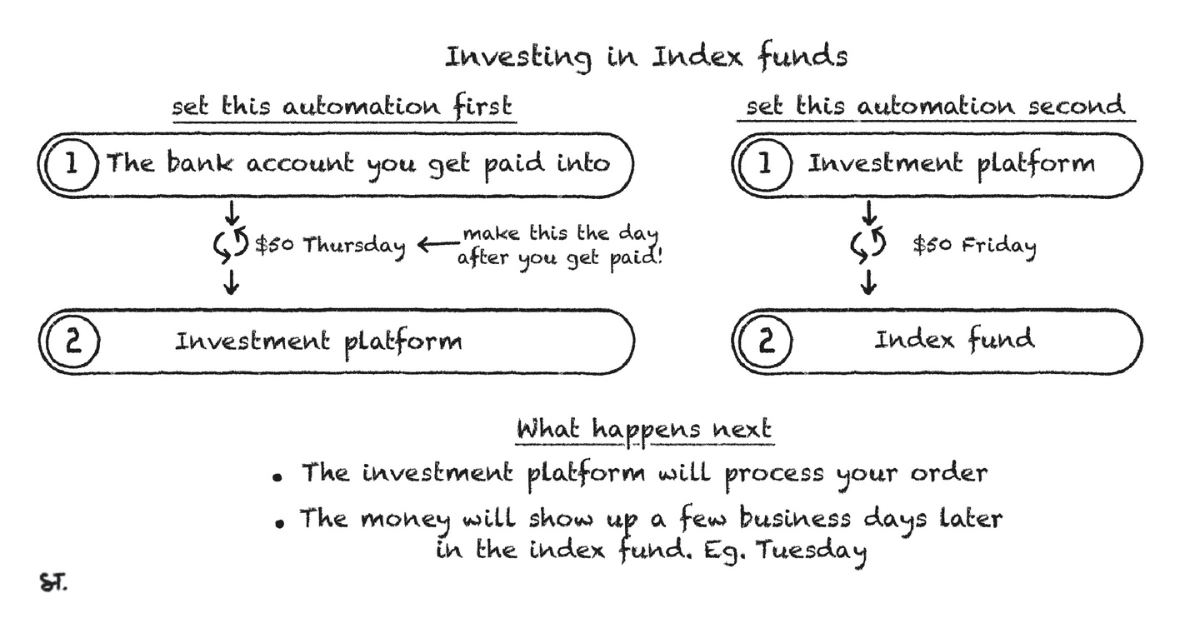

The diagram below captures what you need to know. Keep reading for a more detailed walkthrough.

Apply these steps to automate how you invest in index funds.

- 🧪 Do a Manual Confidence Booster. (e.g. Invest $50 by sending a one off payment to your investment platform. Once the money appears on the platform, invest it manually into your fund of choice.)

- 🧠 Learn and reflect. Did your money end up where you thought it would? How do you feel seeing your money invested? Did you notice the fees that got taken out of the initial amount you deposited? Do you understand why the value of your investment is going up and down? It’s okay to linger on this step for a while.

- ⚙️ Automate your investment.

- Google search how to set up an automatic investment for the platform you are using. (e.g. “InvestNow automatic investment”. Most platforms have good articles, because investment platforms are incentivised to make it as easy as possible for you to invest consistently over a long period of time.)

- Set up the automations. To invest $50 per week, you will need to set up two automations. (See diagram above.) The first automation will need to be set up on your internet banking. I’ve set mine up to occur the day after I get paid, which is a Thursday. This automation takes $50 from my checking account and sends it to the investment platform I use, which is InvestNow. The second automation will need to be set up on the investment platform. I’ve set mine to occur 1 day later on Friday, which allows some time for the funds to arrive from my internet banking. This automation takes the $50 from the investment platform and sends it to my fund of choice, a low cost Vanguard fund.

- 🕵️ Monitor the progress of your money the first time. When I first set up these automations, I checked on Thursday that the first automation had worked. Then on Friday, I checked that the second automation had worked. The following week, I also checked that the money was invested into my fund of choice. Monitoring the movement of your investment manually gives you a greater understanding of the timing and therefore, on what days to set up your automations to happen.

- 📈 Measure your progress. Open a spreadsheet (I use Google Sheets) and in the first column write ‘Month’. In the second column write ‘Amount’. Set a calendar reminder on the 1st day of each month to log into your investment platform, note the Amount your investment is worth and record this in your spreadsheet. For bonus points, use the data to create a graph – it’s incredibly motivating and fun to see your progress over time.

You will make some mistakes and there will be some unexpected surprises. That’s okay. This is the completely normal cost of learning and trying new things.

Automation for investing in your business (for the self-employed)

When you are self-employed, there always seem to be more pressing problems than setting up a system to manage your money. The hidden cost here is that it causes unnecessary stress and uncertainty. It also undermines your confidence in making smart investments into your business. Taking the time to set up a simple system for investing in your business, automating where you can, goes a long way to removing a lot of unnecessary anxiety business owners feel around money.

GOAL: make it easy to invest in your business.

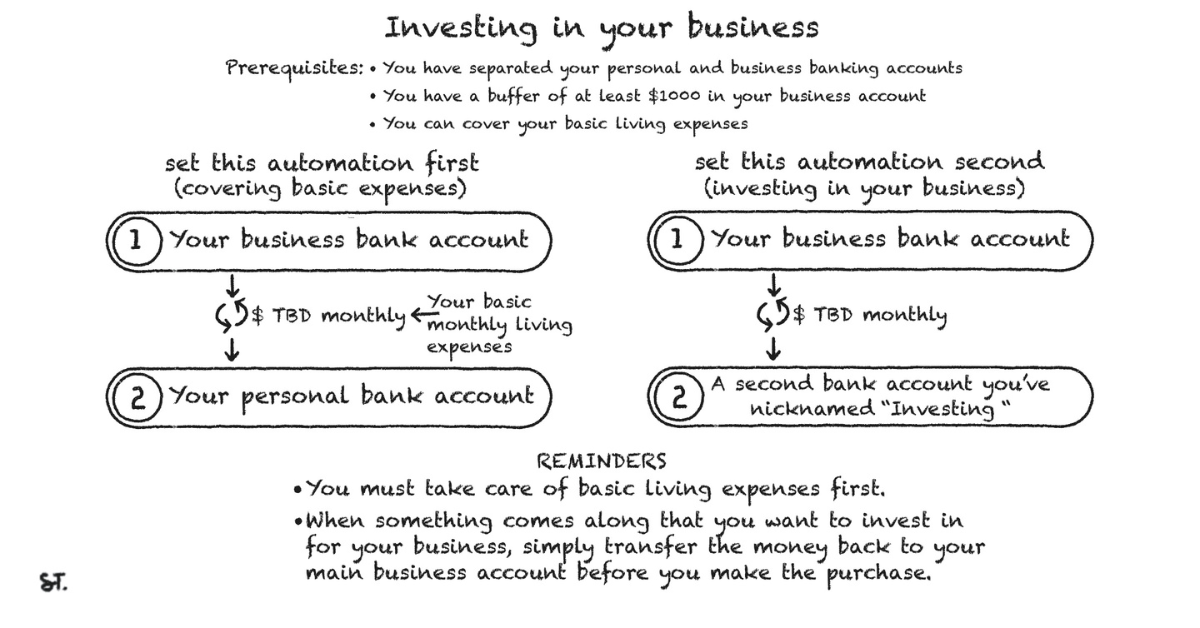

The diagram below captures what you need to know. Keep reading for a more detailed walkthrough.

Apply these steps to automate investing in your business. To make this easy, first we are going to create a good system to cover our basic living expenses.

- Set up your business accounts simply. Keep your personal banking and your business banking separate. You may even want to use different banks.

- When your business generates any income, get everyone to pay into your business account. This makes it easy to track income over time.

- Create a buffer of at least $1000 in your main business account and maintain this base amount. Consider this base amount $0. Anything above this base we will use to cover basic living expenses and then to invest in the business. You can increase this base to 5k or 10k when your business becomes more profitable.

- Estimate your monthly business income and expenses. The difference is what we have to play with—for covering our basic living expenses and investing in our business.

- Calculate how much you need each month to cover your basic living expenses. Add a little extra to allow for unexpected events. Anything remaining can be for investing in your business.

- ⚙️ Set up 2 automations. Given the fluctuations in business income, setting up monthly automations is a good way to go. The first business automation is for covering basic everyday expenses. It will send money from your business account to your personal account. The second business automation is for investing in your business and will send money from your business account to a second account in your business banking. This account can be nicknamed something like ‘Investing’. Any money in Investing is specifically for the purpose of investing in your business and is not allowed to be used for anything else. Whenever you want to invest in your business, you simply transfer the money from Investing to your main business account. Psychologically it is so much easier to give yourself permission to invest in your business when you have already set aside money each month to do so. The same can be said for knowing your basic living expenses are covered too.

- 📈 Measure your progress and reflect on how much you are investing into your business. Open a spreadsheet (I use Google Sheets) and in the first column write ‘Month’. In the second column write ‘Amount’. In the third column write ‘Return’. Set a calendar reminder on the 1st day of each month to log into your business Investing account, note the Amount you have invested and record this in your spreadsheet. In the Return column, make a few notes about whether it was a good investment. It’s motivating and fun to see your progress over time. You’ll become a better investor in your business with practice.

If you want to take automating a step further, you can also automate your taxes! I’ll probably write an article about this in the future, but in the meantime, I’ve heard a lot of good things about the Wellington company Hnry. Just make sure you run the numbers and decide if the 1% fees you’ll be paying to them are really worth it.

When not to automate

There are some payments that are best left to be done manually. When it comes to bills, this includes things like irregular payments or annual subscriptions. Many online platforms will force you to set up an automation when you purchase an annual subscription. For annual subscriptions, such as my Duolingo subscription, I have a recurring calendar reminder set 1-2 weeks before each one is due to remind me to reconsider whether I really need it. Often I don’t.

The auto-renewing nature of online subscriptions makes it too easy to keep paying for something you don’t really need. I also keep a list of these annual subscriptions in a Word doc called ‘annual payments to anticipate’.

Automating is art

Automating is more art than exact science. I like to measure twice, cut once. Weekends are a good time to set up automations, when you have time to linger on how you want to approach them.

Automating helps you get your money invested sooner and growing faster. As the old saying goes, it’s time in the market, not timing the market.

How much should you automate? It depends on your goals. If your goal is to have $1m invested, the speed at which you want to get there will inform how much you need to automate. This is why we spent the first two articles discussing how much is enough. While investing something is almost always better than investing nothing, how much is a good amount for you depends entirely on your vision and your current situation.

I put off automating things for years, because I liked to touch and feel where the little money I had was going. Now, I automate as soon as I can. When you let computers do what computers were invented for, you have more time to be human.

Next steps

Once you have taken action by automating how you invest, the next step is to navigate all of the pleasant and unpleasant surprises you will encounter along your investing journey. This is the topic of the next article in this Money Series. Click here to continue learning.

###

Art by Sierra Truong

Thanks to Hamish Bulsara, Christine Chow, Louie Curnow, Cynthia Gao, Clarissa Hirst and Emily Zhu for reading drafts of this.

Also to Dave Cameron, Sierra Truong, Claire Twyman, Adam Walmsley and Pippa McCormack Wolf for reading a very early draft.

Get more things like this in my free weekly newsletter 3 Things.

Disclaimer: Like your all-knowing uncle telling you the latest stock tip, this should not be considered financial advice.

Leave a Reply