This is the first article in a series on money I’m writing. The reason for this article being first is because answering the question ‘how much is enough’ is the one thing you can do that will make the biggest difference to your enjoyment of your life’s journey.

Do you know how much money you need to never have to work another day in your life? Whether you love your work (like I do) or you don’t, knowing this changes everything.

Of course, nobody knows exactly what the future holds, but knowing how much money you actually need gives your life direction and makes it easier to navigate. There isn’t much about the future which is in your control, but deciding how much is enough absolutely is.

One of the best kept secrets in personal finance is that knowing this number—how much is enough—will make your whole life more enjoyable. It sounds ridiculous, but this has been my experience. When you understand how the simple maths works, you will feel in a lot less of a hurry to rush towards the finish line. Instead, you can just relax into the journey, knowing the direction you’re headed towards. At school, I was lousy at maths and I still am. My school-age self would not believe I am saying this, but I’ve finally found a real world application for maths.

Let’s dive in!

How to work out ‘how much is enough’

- 🎨 Create a vision for your ideal life in the future. Add vivid details and allow yourself to dream. Are you married? Do you have kids? Where do you live? Where do you work? Do you even work? What do you do with your time? What experiences do you want to have?

Author Ramit Sethi talks about ‘creating a vision for your rich life’. He has an excellent article on the subject here. The easiest way to do this step is to write a bullet point list or create a vision board. - 🧮 Work out your current expenses by getting an average over the last 3 months. The best way to do this is manually, so you can ‘touch and feel’ your expenses. Log onto your internet banking, set the date range to the last 3 months and add them up. There are paid apps that can help you track your expenses, such as PocketSmith, however at this initial ‘getting a snapshot’ phase, it will be faster and you’ll learn more by adding up your expenses manually on a calculator.

Knowing your total monthly expenses over the last 3 months gives you a good idea of where your spending is today. For now, it doesn’t matter what the numbers are, it just matters that you know them. Expenses matter the most when it comes to figuring out how much is enough. - 🔮 Estimate your future annual expenses. How much per year would you need to live the ideal life you visualised in Step 1? Another way of asking this question is, how much would you be happy to live off? Hint: it won’t be less than your current annual expenses! Eg. $40,000

→ Be honest with yourself – how much would it cost per year to fund your vision for your ideal life? A back of the napkin estimate is good enough here. The purpose of writing down actual numbers is not to make you feel bad about how much your ideal life will cost. It’s to assign real numbers to your vision. You can have two numbers—one number for the best case scenario and one number for a life that you would still be happy living. This second number is the magic number. It’s the first time in this process we have an amount of money we have defined as ‘enough’. So spend a bit of time thinking about what this is. It’s totally normal and okay to spend a few weeks refining your ideal life vision. You know you have completed this step when you have a vision you love and estimated annual expenses to fund that vision that you actually believe will be achievable. - 🐧 Apply the 4% rule. To do this, take your future annual expenses and multiply it by twenty-five. This is your answer to the question “How much is enough”.

Eg. $40,000 x 25 = $1,000,000

For more on the 4% rule, read this article. It’s one of the most read articles on the internet for a reason. - 📈 Use a compound interest calculator to project when you will have ‘enough’. Putting an actual date on when you will have enough money to fund your ideal life in perpetuity is incredibly exciting. Play around with the numbers in this calculator. See how much a little bit extra invested today can make a massive difference to when you will have enough. What we’re after here is an exact date. Write it down so you can check back on your projections in a year’s time. In the field ‘Estimated Interest Rate’, I’d recommend entering a conservative 6%.

Example

This is how my partner and I worked out ‘how much is enough’.

- Create a vision for your life in the future — We each created a vision board for ourselves in Canva and then talked about them. From here, we came up with our combined vision. We got really specific and wrote this down in 5-10 bullet points. The more specific you get here, the crazier this vision should seem to others. Some of our bullet points included:

✈️ Live 9 months of the year in NZ and the other 3 with our family in Australia and Vietnam

💸 Financially independent—working for money is optional

🏠 Can buy a house outright, in cash, if we want to

🍽️ Eat out twice a week

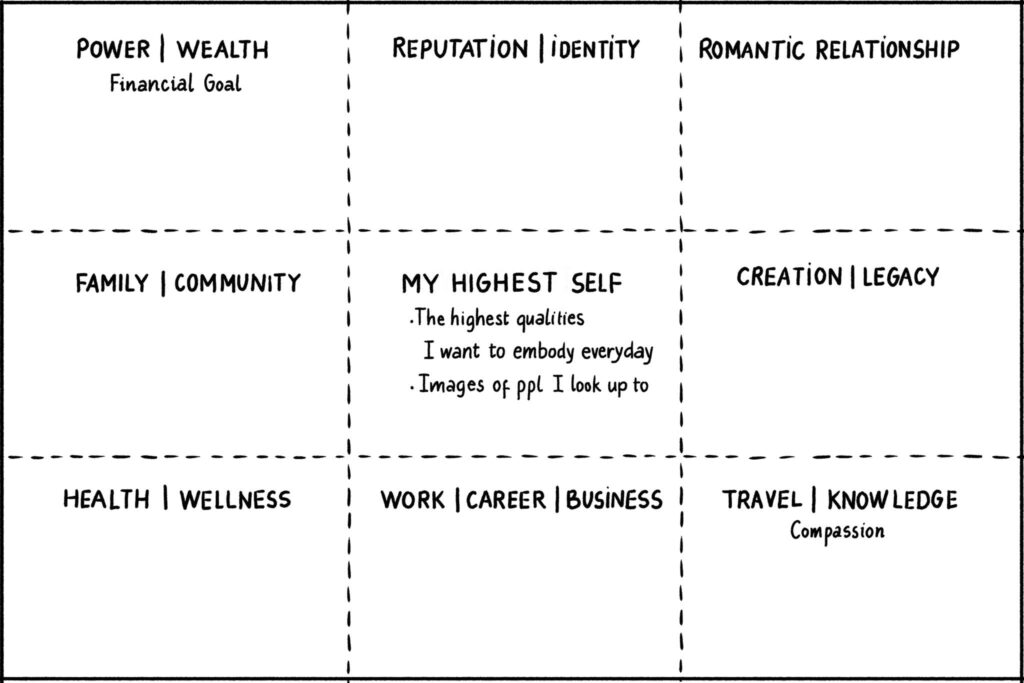

Here’s a great way to structure your vision board so you don’t miss anything:

- Work out your current expenses — Our last 3 months’ expenses:

📆 February: $2096

📆 March: $1978

📆 April: $1686

Taking the total from these three months and multiplying by four, you can estimate we currently spend around $23,000 this year. - Estimate your future annual expenses — A number my partner and I would be happy to live off in the future would be $40,000 per year. For simplicity, we haven’t factored in inflation, since there are also likely to be variables that work in our favour too (like a payrise, or a lucky break or an inheritance). We’re not relying on any of those lucky breaks happening, but it’s statistically likely at least one of those things will happen over the next 50 years.

- Apply the 4% rule — Applying the 4% rule to our future annual expenses: $40,000 x 25 = $1,000,000

This means that when we have $1,000,000 invested in assets (for us, it’s low-cost Vanguard index funds), we could withdraw $40,000 per year and stop working with close to 100% certainty that we would never run out of money. This is our answer to the question “How much is enough”. - Use a compound interest calculator to project when you will have ‘enough’ — Entering our numbers into the compound interest calculator, with a conservative 6% interest rate, projections suggest we’ll get to $1 million by the age of 45. We’ll see!

The surprising thing about deciding how much is enough

A surprising side effect of going through this process and understanding how the maths works is I feel in a lot less of a hurry to rush towards the finish line.

‘Enough’ doesn’t have to be some crazy unattainable number. In fact, you may need less than you think.

When creating a vision for your ideal life in the future, it might be tempting to seek inspiration by looking at the things you don’t currently have. The good news is that there is actually a lot of research to support the idea that the things that make life worth living aren’t things you need much money for.

Here are some great resources I’ve come across in my own research which—by learning from others’ experiences—might help you determine how much really is enough:

- 🎧 Listen to multimillionaires on podcasts—such as I Will Teach You To Be Rich—talk about how becoming multimillionaires didn’t change anything about how they felt about themselves. Nothing. Nada. Zilch.

- 📘 Read Bill Perkins’ Die With Zero. This excellent book provides a great framework of how to think about your money and your life.

- 🎧 Listen to The Spectrum of Wealth, one of the best episodes of a podcast I’ve ever heard.

Next steps

Once you know how much is enough, you get to decide how to make the money and invest it. This is the topic of the next article in this Money Series. Click here to continue learning.

###

Art by Sierra Truong

Thanks to Laura Cheftel, Christine Chow, Cynthia Gao, Clarissa Hirst, Rakhesh Martyn, Sierra Truong, Cathy Zeng and Emily Zhu for reading drafts of this.

Also to Dave Cameron, Claire Twyman, Adam Walmsley and Pippa McCormack Wolf for reading a very early draft of this.

Get more things like this in my free weekly newsletter 3 Things.

Disclaimer: Like your all-knowing uncle telling you the latest stock tip, this should not be considered financial advice.

Leave a Reply