This is the eighth and final article in this series on money. If you haven’t read the previous articles, start here. The purpose of this series is to maximise your enjoyment of your life’s journey.

In the previous article we explored how to create calm around taxes. Now, let’s discuss how to make money work in harmony with your relationship.

“Love does not consist of gazing at each other but in looking outward together in the same direction.”

— Antoine de Saint-Exupéry, Wind, Sand and Stars

“If you want to go fast, go alone, if you want to go far, go together.”

— African proverb

Have you ever loved yourself and a special someone so much that you were willing to combine finances? Despite sharing everything else, money is often the last thing that couples decide to share. A common thought goes something like, “What if combining finances complicates the relationship or worse, makes them think I’m greedy?” 🤑

Each person stands in their corner of the ring, protecting what they have accumulated, not wanting to make the first move, unaware of the true opportunity cost. The good news is it’s never too late to form a truly united team. 🥰 🥰

If your finances are separate, start asking questions

How do you know if you’re ready to combine finances? There’s no magic bullet. You’ll never be 100% ready. Everyone has to decide for themselves. And then you also need to decide as a team. Two distinct steps. Both necessary.

From my own experience combining finances with my partner, which I’ll discuss in more detail below, what helped us know we were as ready as we were ever going to be was:

✅ We lived together

✅ We had a good sense that we’d found our life partner

✅ We could talk about difficult things with each other—there was a history of transparency and good communication

✅ We realised that the pain of not combining finances was becoming greater than the pain of continuing as we were

That last point, in practice, meant it was going to be harder to achieve our goals and support one another through life’s ups and downs if we continued to keep our money separate.

So if you live with your partner, have a good sense that they’re ‘the one’ and yet you still manage your money separately, take a moment right now to ask yourself, “Why?” I want you to get really curious. Pull out your detective’s hat and magnifying glass 🕵️ and ask yourself in a non-judgemental way:

- Where did I learn this behaviour?

- What do I get by keeping our finances separate?

- What is the cost of keeping our finances separate?

- What would I get by combining our finances?

- What is stopping me?

Then, invite your partner to answer the same questions. 🕊️ Come together and share your answers.

You don’t have to change anything or have any outcome in mind. Just talk, listen and see what you can learn about one another. Hint: you will learn a lot.

What if I don’t trust my partner?

If you’re scared that things will go wrong in the relationship, know that this is a common thought. You don’t need to do anything until you are ready. But you do need to take responsibility for the way you feel. If you don’t face this now, there will come a time in the future when you will need to deal with it. So might as well deal with it now! ✨ Again, the best way to approach these feelings is by getting really curious and courageous.

Try asking “Why” five times to get to the root cause of your feelings.

For example:

I don’t want to combine finances right now.

Why?

Because I don’t trust my partner.

Why?

Because they spend everything they earn and I’m worried that if we combine finances they’ll spend all our money.

Why?

Because they only think about themselves.

Why?

Because they don’t love me.

Why?

Because I don’t deserve to be loved.

Wow, that hypothetical got deep quickly! This is the power of the Five Whys. [1]

When you understand the 🫚 root cause 🫚 of a problem, you can solve it effectively, instead of getting distracted by its attention-grabbing symptoms (like the lack of trust you may feel towards your partner in the example above).

The root cause of issues relating to how we relate to others often end up having something to do with how we treat ourselves. This can be empowering, because the fix is within our control. It’s surprising how often any issue, especially relationship issues, can be quickly solved by asking the question, ‘Am I taking responsibility for my own happiness?’

Therapy helps, but you can also just dive in together with your partner if you feel safe to do so.

There’s no right or wrong way with any of this. The process I’ve outlined above is just one way to lay the foundations for a constructive discussion about combining finances.

What happened when I asked myself these questions

When I was asked these questions a couple of years ago by my money mentor Ruth Henderson of The Happy Saver, I was intrigued. I had never really thought about these things! My partner Sierra and I had been together for two years at that point. We lived together, shared everything else and had a fantastic relationship. Why change anything?!

Sometimes there are good reasons why you might want to keep your money separate. But the important thing is to really interrogate those reasons.

One thing Ruth said that surprised me is how in New Zealand, the law states that if you have been living with someone in a marriage or de facto relationship for a minimum of 3 years, and you break up, all relationship property is divided 50/50. [2]

Sierra and I either needed to get a relationship property agreement written up, or else we were equals in the eyes of the law anyway. Everything would be split 50/50.

I recently read over my original notes from the original conversation I had with Ruth about combining finances. Here are some of the other points I jotted down at the time that also resonated with me:

- 🚶 By not combining finances, I could be heading off in my own direction without bringing my partner along.

- ⚖️ The best time to combine finances is when you’re both in a similar financial position.

- 🕊️ Sharing money is a block for most people, even when you share everything else with this person. When you let go, it really unites people.

- 😌 It will give my partner huge peace of mind to know that we have our money sorted.

- 🕵️ Transparency around finances has not always been common in society, especially for women. It can be great for them to see what others are getting paid.

Ruth also asked me the question, “What will you do when one partner’s income drops to zero?” When you’re in your 20s or 30s, one thing that is hard to appreciate is how many ups and downs life will put you through financially. Almost all of them will come out of nowhere.

“What happens when one of you loses their job? Who’s going to pay for things? Is one of you going to live in poverty while the other lives it up?”

All of these excellent questions helped me to see what we were missing out on by keeping our money separate, and what we stood to gain by putting our money together.

It felt uncomfortable to reflect on what might be subconsciously stopping me from being more positive about combining our finances. It didn’t take long to figure out where this resistance was coming from, but I was still surprised by what I found, because I had never consciously thought about it.

By asking ‘Where did I learn this behaviour?’ I realised I had internalised some of the stories my dad had told me over the years. Being in his 60s, he’s seen a lot of his male friends get divorced over the years. And it’s those divorces at the extreme end of the spectrum that he would tell me about, and would stick in my memory. When the money story you’ve internalised is ‘your partner will strip you for everything you’re worth’, combining finances seems really, really scary. Sorry, make that really, really, really scary. 😱

It hit me that this story, that wasn’t even mine, was holding us back. And if I didn’t do something about it quickly, it was going to influence our relationship for the rest of our lives. I needed to write a new story. ✍️

Through further conversations with friends, family and Google, not to mention chats with Sierra, I realised that I absolutely wanted us to go through life as financial equals. At that time, I was earning a lot more than Sierra, so I would happily pay for most of the things we did together. I suspected that would not always be the case, and that one day in the future it would flip. Maybe I would lose my job (this ended up happening 1 year later), maybe Sierra’s business would take off (yet to happen, but maybe one day!). As much as I wanted to share my success with her, I wanted to be able to share in her success too! And when I was going through a tough time, I also wanted to feel financially supported.

So one day, on a hike, I sat her down next to a beautiful stream and said something like this:

“Remember how talking to Ruth made me think about how we keep our money separate? Well, I’ve realised that I think the reason I was so resistant to joining our money together at first is because I didn’t have any good role models on how to do this—most of the stories I’ve heard on combining finances end in my dad’s friends getting divorced and being left with no money—plus, I also didn’t understand the opportunity cost. By keeping our money separate, it’s harder to achieve our shared goals and it’ll be harder to support one another through the ups and downs of life. Just because things are going well for me right now, doesn’t mean they’re always going to be. Some day, I’ll probably lose my job and would love it if you were able to support me if/when that happens. Same as how I’d love to continue supporting you while you build your business. Now that we’ve been together for almost 2 years, I was wondering if you’d be up for exploring how we might be able to combine our finances. So everything that’s mine is yours – all the index funds, retirement savings, everything – and vice versa. I would love us to be able to share in one another’s success and be able to better support one another when we’re going through a tough time. What do you think?”

Yep, I kinda vomited out that word salad, but Sierra immediately understood my intention—to unite as a team financially to make it easier to support one another and achieve our goals.

Over the coming months, we continued to talk about it, working through the details. Sierra had some understandable fears around the fact I had more in savings than she did and what this meant for us. I listened and made sure she had plenty of opportunities to get these thoughts out in the open.👂

Reflecting on this time, Sierra says, “I had fear about being seen as a gold digger. I was worried I would slow you down, weighing you down like an anchor and that you would do much better financially on your own! I didn’t want you to regret it later. I was also worried it would put pressure on our relatively new relationship.”

I’d had some version of the same fears, but had just had slightly longer to work through them. I was pretty confident that though these were super valid concerns, it would still be worth the risk. The upside of going through life as a truly united team was too great to ignore.

When faced with a difficult decision, I find it helpful to ask ‘What could go right?’ Asking this question repeatedly ensured we didn’t take our eyes off the prize as we talked through our valid worries.

Since taking the plunge, it has turned out to be one of the best decisions we’ve made as a couple, second only to the decision to get together in the first place! We’ve achieved more, been more effective at supporting one another financially, and it’s had a surprisingly big positive effect on our overall happiness. It’s such a nice feeling to know we’ve got each other’s backs as financial equals.

Both of us play an active role in managing our money and I love that. I’m a little more into this stuff than Sierra is (she is yet to write an eight-part money series on her blog), but to her credit, she’s become really savvy with money in the last couple of years as a business owner, and we make better decisions together than we ever did on our own. I don’t think that would have happened if we’d kept our money separate. A shared vision and skin in the game changes everything.

Whatever you and your partner decide to do, when in doubt, keep listening, keep talking, and go back to your values. The only right decision is the one that aligns with your shared values.

The benefits and drawbacks of combining finances

| Benefits | Drawbacks |

|---|---|

| Significantly easier to achieve goals and support one another when you are financial equals. Two people working in the same direction will go further than two people working in different directions. | Less independence |

Increases transparency and trust. | If one person is bringing debt into the relationship, once you have been in the relationship for three years, this now becomes the legal responsibility of the both of you. Note: in New Zealand, this is also true once you’ve been living together for 3 years, regardless of whether or not you combine finances. [3] |

| Sharing responsibility for the family finances means everyone has skin in the game, making it easier for everyone to care about the family finances. This also has the effect of improving communication. | If you haven’t chosen a great teammate, combining finances will cause this to become apparent pretty quickly. Note: this is also a benefit. Wouldn’t you rather find out now if this is someone you want to spend the rest of your life with? |

| More simplicity in the way you manage your money. | If one person has a history of being irresponsible with money, you may be putting yourself at risk by combining finances. This risk can be mitigated by establishing some clear boundaries at the outset, and allowing a degree of judgement-free spending. |

For more on what to consider before combining finances, Sorted gives an excellent overview in their article about relationships and growing money together.

How to start — Step 1 — Have a conversation

Having a conversation to get to know each other’s financial situation is the best way to begin. This allows you to start your journey together. This conversation is all about being transparent with one another and casting no judgement. 💬

Lay everything out until there is nothing left.

Here are the main things to consider:

- Income (list all income sources and amounts)

- Expenses (categorise them and get a total from the last 6 months)

- Assets (any cash, real estate, shares, bonds, crypto, gold etc.)

- Debts (credit cards, student loans)

- Total net worth (income and assets minus any debts)

- Upcoming changes to your financial situation (work bonuses, salary increases, moving house, inheritances)

Check out some of the other questions Sierra and I asked one another at this stage in our journey. This step works best if you both get really curious and have fun learning about one another’s financial situations.

By laying all this out in front of one another, you’re setting yourselves up to make great decisions as a team, even if you decide not to combine finances right now.

How to start — Step 2 — Share your passwords

Before we discuss the principles and the nuts and bolts of combining finances, let’s continue building the muscles we’ll need to make combining finances easier. A great next step in the right direction is to share your passwords with one another. 🔑

Imagine that you died tomorrow. What would the other person need to access to make things easier? Give them access to that, plus a little more for good luck. This can include the passwords to your laptop, phone, Apple ID, myIR, mobile provider, email provider, internet banking, your cloud backup and other subscriptions.

The way Sierra and I manage this is through a shared Notes doc on our phones. You can also use a Google doc, or a more secure alternative like 1Password/LastPass. Make sure you can access it from your phone.📱

Sharing passwords costs you nothing and sets the tone of ‘everything that’s mine is yours’, which can eventually lead to more important things being shared. Like money.

4 principles of combining finances

These principles are best used as guideposts while you explore combining finances with your partner. Keep them front of mind to increase the likelihood of success.

1. Discuss and accept one another’s views on money — Combining finances starts with talking to one another. It’s not one big, all-encompassing conversation. In reality it looks like lots of little chats. 💬 Your job is to listen deeply and non-judgmentally to understand your partner’s hopes, dreams and fears with money, and to help them figure out where these beliefs came from. It’s not about trying to change the other person. It’s about accepting them as they are. By being interested and listening to your partner’s money stories, they will be more open to listening to your point of view. From here, you will have an opportunity to start helping one another overcome your limiting beliefs around money. We all have them.

2. Decide together — One person has to be the first to suggest combining finances, but the final decision must be made together. Nobody wants to feel backed into a corner. If your partner isn’t ready, that’s totally okay. Instead of being upset, go back to the previous principle and get really curious. You can say, “Thank you for being honest with me. I am really curious, what do you think it would take for you to feel excited to combine our finances?”

It’s also entirely possible that you didn’t clearly communicate the reasons why you want to do this. Try framing your reason as a benefit to the other person. When I proposed this to Sierra, I didn’t say, “I want to combine finances so you can take care of me when I’m broke.” Instead I said, “I want to combine finances so we can be true financial equals and so we can support one another through the ups and downs of life.” 🎢

3. Set some rules together — Sierra and I have a rule that says we will discuss any purchase over $100. If it’s less than $100, we don’t need to talk about it (though we typically will if it’s over $50). When in doubt, always discuss first. Not to get permission, but to decide together if this is something you both believe is good to spend money on and will get you closer to your goals. You can make up your own rules. For some of you, $100 might seem too low/high. Write the rules down somewhere you can both easily access. If you have a relationship property agreement together, add that in here too.

Another rule we have is that both of us have equal access to everything. We both have a card 💳 linked to our checking account, and we both have access to all the passwords, even ones we decided to keep in one person’s name.

4. Adjust the rules to the seasons of your life — When things change in a significant way, come together for a conversation and adjust your approach. When I was made redundant, we needed to update the way we manage our finances. Most of the time, this just looks like figuring out what amount of weekly income we expect for the foreseeable future, reviewing what we are allocating money towards every week, then updating any automations. ⚙️

The nuts and bolts of combining finances — how to actually do it

You’ve decided to be a true team in every sense of the word and combine your finances. What now? The first thing Sierra and I did was to make a plan. This looked like me jotting down some notes, then discussing them. I still have my original notes from this planning session!

My unedited notes from our first planning session after we decided to combine finances:

Research

- Look into the different ways people combine finances

- Pick and choose the best parts

Things to consider

- Taxes

- How I can still pursue financial independence

- Do we put Sierra’s name on my index funds

- Do we put my name on her business accounts

- Might be worth speaking to an independent financial advisor to find out the best way to combine finances. See Mary Holm’s list of fee-only advisors.

- KiwiSaver gov contribution, make sure we both get it

- After 3 years of living together, the Property Relationship Act comes into effect, which means that if you split, you have to split your assets and liabilities 50/50.

Questions

- Are there any debts either of us is liable for in Aus, NZ or Vietnam?

- What do we do if one partner’s income drops to zero? Talk about it and consider options. Consider using an emergency fund.

- Do we want to create a relationship property agreement?

- Would I have to pay tax on Sierra’s business income and expenses if my name was added to the business accounts?

Things that would be good to have

- One account we both get paid into and spend from (we both have a card linked to this account). Keep a buffer of $1k in here for unexpected payments to crop up.

- A joint emergency account that we always keep at a certain number (review number on a 6-month basis)

- XYZ Sinking funds

- A business account for Sierra

- A tax sinking fund for Dean

We ended up doing all of the above, except for:

- Seeing a financial advisor. After doing a little research, it became pretty clear what was going to be best for us. If our situation was more complicated, we might have benefitted from getting some professional advice.

- Creating a relationship property agreement. Neither of us was coming into the relationship with a ridiculous amount of assets, so it seemed unnecessary.

- Putting my name on her business accounts and her name on my index funds. We decided against this for tax reasons—it’s simpler if it’s in one person’s name. However, we are currently rethinking this. In the event that one of us dies, we want the other person to be okay financially and most of our net worth is tied up in these two assets. The likely outcome here is that instead of adding both names to these accounts, we end up drafting some wills.

To this day, whenever something comes up that we want to reconsider or discuss, I’ll jot down a few notes in our ‘Combining Finances’ Word doc. 📝 It’s very helpful to have a record of why you made the decisions you made, in case you need to revisit them.

Setting up our bank accounts

The right bank account setup for you and your partner is one that aligns with your shared values. Do you value complete transparency, do you value maintaining some independence, do you value simplicity?

For us, we placed the highest value on simplicity and transparency. We also wanted to make it easy to achieve our goals.

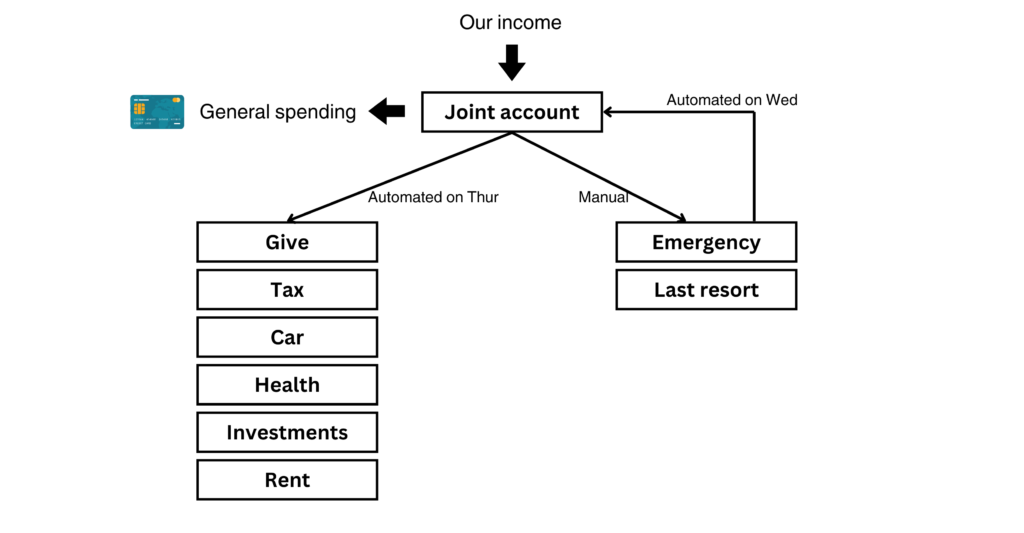

This is how we have our bank accounts set up today, when I’m not working full time (I’m currently on the job hunt).

Because I am in the process of looking for work, we are living off our emergency savings.

Step by step:

- Any income goes into our Joint Account. I manually transfer this income to our Emergency Account.

- On a Wednesday, an amount we have decided in advance gets automatically transferred from our Emergency Account to our Joint Account. For context, our Last Resort account serves as a second emergency account. We used the money in here first, before using the money in our Emergency Account.

- The next day (Thursday), automations send money from our Joint Account to where we have decided in advance we want it to go.

- The amount of money left in our Joint Account is what we use for General Spending. This number is the same every week. We each have a debit card linked to this account that we use to spend.

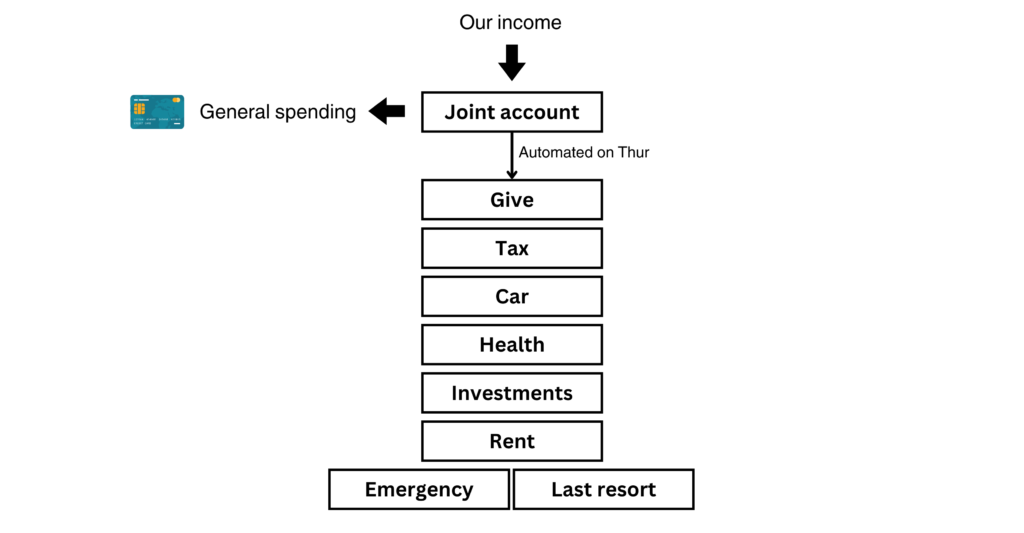

The diagram below shows what our system looks like when I’m employed full time. I consider this the purest expression of how we manage our money as a couple.

Step by step:

- All income goes into our Joint Account.

- The day after I get paid, automations send money from our Joint Account to where we have decided in advance we want it to go.

- The amount of money left in our Joint Account is what we use for General Spending. This number is the same every week. We each have a debit card linked to this account that we use to spend.

This system has worked tremendously well for us since we combined our finances a few years back.

A few other nitty gritty details that makes our system work:

- We keep a base amount in our Joint Account (for us it’s $1,000). We treat this base amount as $0. This provides a nice buffer so that we never accidentally overdraw. [4]

- Whenever we need to pay for something related to one of our sinking funds (Give, Health, Tax, Car) we’ll pay for it as per normal, then one of us will manually transfer the money back into the Joint Account from that sinking fund to ‘replace’ the money that was spent.

- Any money Sierra earns from her business, along with any related expenses, is handled completely separately. When I’m working, we live entirely off my income. When I’m not working, we live off my savings. While it would be nice if Sierra’s business generates more income in the future, it’s not necessary for us to achieve our goals. 🎯

Other things to be aware of when combining finances

Here are a couple of other random tips that I found helpful when first navigating joining finances.

- When all your checking accounts are in both of your names, the IRD will split any interest earned 50/50.

- Even after you combine your finances, each of you still files an individual tax return.

- Once you are comfortable the new system is working, close your old bank accounts. If one person has a business, you don’t necessarily need both names on these accounts. But it’s good to make sure the other person has access by sharing all your passwords and making sure that your wills state ‘what’s mine is yours’.

- 💍 Getting married invalidates any will that was written prior to marriage. So to prevent this, if you happen to be writing a will before you get married, be sure to mention somewhere in there that ‘I am doing this in the contemplation of getting married.’ This ensures your will remains valid in the event of marriage.

- When combining finances, never ever sell your shares. By transferring shares to another person, they get sold and then repurchased, which creates a capital gains tax liability.

- Only put both you and your partner’s name on an asset if there is a benefit. The guiding principle here is that you want to make sure that if something happens to the other person that you can both access it. For example, if you’re both saving towards a home.

- I’ve touched on this already, but it bears repeating: if one person is coming into the relationship with significant assets, such as a property or a bunch of investments, then it can be a good idea to get a relationship property agreement written up. This just means that in the event of separation, that asset will not be on the table to be split 50/50, as everything else will be. In this way, it’s similar to a Prenuptial Agreement.

- Many people like the idea of having a personal bank account with a card linked so they maintain some independence and buy whatever they want without the other person knowing eg. gifts.

I’m a little suspect of how often people actually use this money to buy surprise gifts for their partners, but I can definitely see the benefit of the independence this gives you. For Sierra and I, we prefer the simplicity of 1 card each, linked to 1 Joint Account where income goes in and expenses come out. There’s no right or wrong way with any of this. As I’ve already mentioned, the only right decision that exists is the one that aligns with yours and your partner’s values.

Happily ever after

Combining finances is the ultimate leap of faith and the ultimate act of giving. 🎁 You are giving to your partner, while also being open to receiving what your partner has to give. It can be a truly beautiful exchange of energy.

My partner Sierra says, “For me, joint finances frees up my mental space & deepens our bond as romantic partners. It evokes a feeling of home & family (without needing to sign marriage papers). It also motivates me to keep learning about money.”

Start from a place of curiosity. Really listen to one another do the necessary inner work to work through any resistance. Time and again, go back to your shared values. These will guide the way. Ask yourselves, ‘What could go right?’

When you burn the boats and decide to become a true team financially, you are trusting that you will both be able to come together to figure out whatever challenges life throws your way. Stakes this high have the effect of focusing yours and your partner’s thinking so you can do more and go further together than you ever could have imagined alone.

Helpful links

Interestingly, podcasts 🎧 tend to be the best resources that exist for learning about how couples successfully (and unsuccessfully) manage their money.

I Will Teach You To Be Rich podcast — Ramit Sethi

The Happy Saver podcast (a Kiwi podcast)

Here are some other excellent articles on combining finances by Kiwi personal finance writer Ruth Henderson.

Should you combine finances with your spouse

Do you think you should combine finances

###

Notes

[1] The concept of Five Whys comes from manufacturing, of all places. It was first used at Toyota. Its purpose is to help you get to the root cause of a problem.

[2] Sorted has some good resources on how the Relationship Property Act works.

[3] Check out these articles on what happens to your debt when you separate and am I liable for my partner’s debts. There is room for interpretation here – the law is not completely black and white. But to be on the safe side, taking the view that what’s mine is yours (including any debts) will leave both you and your partner better off in the long run.

[4] All of our accounts are debit accounts. We don’t use credit accounts/credit cards and never will for the following reasons, in order of priority: 1. Spending someone else’s money and paying off a credit card would add complexity to our lives. Our primary value when it comes to managing our money is simplicity. 2. I truly despise debt and cringe at the idea of using money that isn’t my own. To give you an idea of how strong this belief is, we have a mini goal to buy a house all in cash one day! 3. Unless you live in America, the rewards you get for using a credit card are not worth the trouble or risk you take on to get them. Rewards are something marketers use to seduce people into making credit cards more approachable. I liken it to Ronald McDonald being used to make fast food more approachable to families or the Marlboro Man seducing men into thinking smoking was a good idea.

Art by Sierra Truong

Bank account diagram inspiration by Stephanie Pow

Thanks to Hamish Bulsara, Christine Chow, Cynthia Gao, Rakhesh Martyn and Sierra Truong for reading drafts of this.

Also to Dave Cameron, Claire Twyman, Adam Walmsley and Pippa McCormack Wolf for reading a very early draft of this.

Get more things like this in my free weekly newsletter 3 Thing$.

Disclaimer: Like your all-knowing uncle telling you the latest stock tip, this should not be considered financial advice.